40% of firms surveyed have developed a crypto-monitoring or reporting policy of some kind.

Only 10% of those surveyed feel they have a thorough understanding of how employees are trading crypto-instruments in their personal accounts.

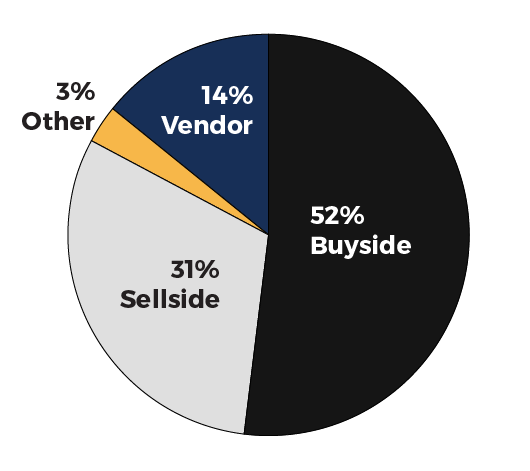

Pro-Monitoring: Firms that (1) currently monitor their employees for crypto exposure, (2) know they want to monitor for it, or (3) expect to have to monitor for it at some point.

Anti-Monitoring: Firms against monitoring their employees for crypto exposure. These firms don’t monitor, won’t monitor, or don’t expect to ever monitor for it, unless regulators specifically require it.

On The Fence: Firms that are in a state of limbo on the subject. They are waiting on movement by regulators, movement by peers, or the continued evolution of the space.

For firms that have developed policies, there is consistency in their thinking and approach:

Bitcoin and Ethereum are considered and treated as transfer of value, like traditional fiat currencies, and therefore not subject to disclosure and monitoring.

All other digital assets, like initial coin offerings (ICOs), are treated as a potential store of value, the same as securities, and are therefore subject to disclosure and monitoring.